9 Finance Apps to Make Cash Flow and Business Growth Correct

Staying on top of your cash flow and business growth indicators is very important when running an SMB. Since smaller businesses may not afford the luxury of affording expensive accountants and bankers, their owners should invest in business automation solutions that extend to their finances.

There are a lot of finance apps that can help business owners know exactly where they are with their finances and how much they can spare. That helps business owners budget and create accurate cash flow statements as well as growth reports. Here are 9 finance apps to control your cash flow and boost business growth.

QuickBooks

QuickBooks provides business owners with a clear picture of their finances and indicated how healthy the company is on the finance side. It has various indicators that you should have your eye on and automates many important tasks that consume a lot of time.

That includes managing the payroll of the business and creating financial statements. The major indicator that is integrated into this app is the business sales and expenses tracking metric.

It indicates whether the business is growing or is spending more than it can afford. You can use that data to restructure the company operations with the intention of cutting back on costs and maximizing sales. Businesses can also use this app to track unpaid invoices that could result in losses incurred by the company.

You can connect QuickBooks with thousands of accounts, including the business bank account, PayPal wallet and Square.

FreshBooks

FreshBooks is a pocket bookkeeper helping small businesses and freelancers to manage their invoices and track its payment. You can use this app across most devices, including iOS, Android and even desktop computers.

It has a simple user interface making it very easy to navigate and complete the tasks you need. FreshBooks has functionalities such as tracking unpaid invoices, organizing expenses, automatically billing clients for recurring payments.

All these features allow this app to create accurate business reports indicating the financial health of the business. You can create business reports such as profit and loss statements based on all received payments and all unpaid receipts.

The invoices created using this app look very professional and will complement your business well. You can also accept credit cards on mobile devices being used for business purposes with FreshBooks.

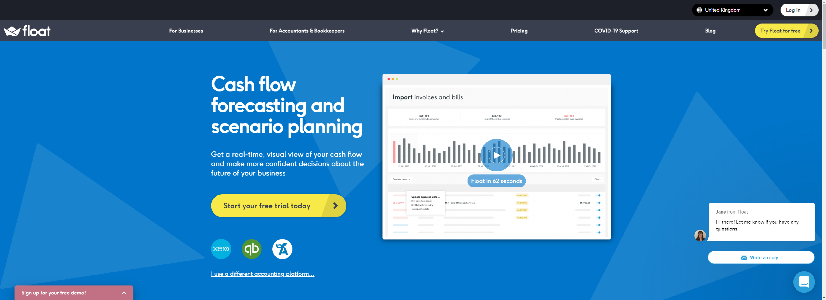

Float

Float is an essential program for busy business owners that do not have the time to collect all the data required to set up a financial app. You do not have to manually input data on this app because it automatically gathers information required.

It pulls information from many different sources that are linked to the finance of the company. The app also integrates with many different accounting platforms to help you understand the state of the company.

Float also helps business owners look into the future of the company and where it is headed by creating cashflow forecasts. Those projections can help business owners plan their growth prospects more efficiently in correlation to the forecasts.

The cashflow projections can start from one year to a couple of years but their accuracy decreases as the timeframe gets longer.

9 Spokes

9 Spokes are the perfect app to digitize several of your business operations including the finances. It has a dashboard that combines many different applications that simplify the lives of business owners.

The dashboard has recommended accredited apps that help track and manage the cash flow of the business as well as its sales. You can choose the ones that work best for you and then add them to the dashboard.

The information from those apps helps to automatically generate graphs and visuals that indicate the state of the company. That makes it easy to understand financial statements and business reports because it is summarized and depicted simply on your screen.

You do not have to switch through apps and spreadsheets to have an idea of how the company is doing. The growth of the business is monitored easily using 9 Spokes and you are just given simple KPIs that are easy to understand.

Mint

Mint has gained much popularity in the budgeting app sector because of its robust features. Although it is mostly used for personal purposes, you can also use it for small businesses.

The app pulls data from all bank accounts and credit cards of the business and unifies them into one place. It then categorizes transactions made from those bank accounts or credit cards and discovers your spending habits.

Afterward, the app uses the insights it has gathered to create tailor-made recommendations and suggestions to improve the business’ budget. You can use Mint to create a very detailed budget with many different categories that can be added as time goes on.

When running a company, you might forget when to pay different bills related to the operation of the business. The app can help business owners remember to pay everything in time with its “Bill Reminder” feature.

Mvelopes

Mvelopes can assist businesses in implementing the old-school method of enveloping the income it has made. The envelope method works on the construct of every dollar having its own job.

It is done by categorizing the expenses of the company and allocating a certain percentage to each category. Although at first, this approach was used with real envelopes, it cannot be done like that for modern businesses.

This resulted in the development of a digital app that categorizes expenses and allows you to allocate the income of the business to the right departments.

All you have to do is create a budget and the app will do most of the grunt work giving business owners peace of mind. You can get more from the company that developed this app including financial coaching and other value-added services.

You Need A Budget (YNAB)

You Need A Budget (YNAB) can help small business reach their growth prospects by ensuring that there are enough financial resources for them. For example, a courier company might have the growth prospects of adding more vehicles to its fleet.

To reach that goal, they need to have enough money to purchase those vehicles. YNAB has a feature that can help that company add a financial goal and work towards reaching it.

With every dollar that is received using the business’ bank account, a certain percentage can go towards reaching that financial goal.

It syncs all the bank accounts and credit cards of the business and unifies them into the dashboard that will be used by the company. The app can also help with monthly budgeting and help you save some extra dollars here and there.

Dollarbird

Dollarbird is an efficient app that helps businesses identify how much they can safely spend. Sometimes a business may face contingencies that need money on hand but spending too much on them can risk failing to pay bills and debts.

To avoid such results, the app combines all the financial responsibilities the business has. They are then put on a calendar and color-coded signaling their priority so that you know exactly when to pay them.

All those costs are then deducted with the income leaving out the cash you can spend on emergencies or everyday business expenses.

The app does not have bank syncing capabilities, so you have to enter the details manually. You can use this to your advantage by perceiving it as a way to be mindful of the expenses and income of the business.

Wally

Wally is an advanced budgeting app with a variety of useful features for small businesses. If you conduct business offshore, this is the perfect app because it supports nearly all foreign currency. That means if you have business interests outside of the US, employees on that side will be able to manage the finances of the company.

It also helps if you are constantly traveling to many different countries for business purposes. You can also save pictures of receipts on the app to stay on top of taxes and other important business reports without having to handle crumpled and creased papers.

The bottom line

It is of utmost importance for business owners to maintain a clear perspective on their finances and to do so they need accurate data. Auditing everything manually wastes a lot of time and can sometimes result in inaccurate data. That is why you should start using finance apps that calculate everything automatically.

All you have to do is connect all the business accounts of the business and cash flow statements will be automatically generated. Some of these apps also forecast the cash flow for business owners to understand where their company is headed. Simplify your business operations by automating cash flow management and business growth reporting.

Scott Mathews is an academic writer, editor and proofreader working for an essay writing help. As a senior writer, he leads a team of dissertation writers and works closely with research students to ensure timely delivery and high-quality of the work.