An Uncomplicated Example of How GST Works

A single tax on the supply of goods and services, the consumer bears only the GST which is charged by who is at the end of the supply chain. Implementation of the Goods and Services Tax, as some economists opine, is the most ambitious of tax reforms after independence.

For an uncomplicated understanding of how exactly GST works, it’s important that we look into what the GST Composition Scheme is all about. To begin with, we define what the GST Composition Scheme is.

What Is The GST Composition Scheme?

The GST Composition Scheme has been introduced to make things easy and simple for GST taxpayers. It is intended to help small and medium taxpayers break free of cumbersome GST filing and pay the tax at a fixed rate of their turnover. The GST Composition Scheme is meant for those who have a turnover of less than Rs. 1.5 crores.

Eligibility For The GST Composition Scheme

Taxpayers who have a turnover of less than Rs. 1.5 crores and in the case of Himachal Pradesh and the north-eastern states, those with a turnover of fewer than 75 lakhs come under the ambit of the GST Composition Scheme. It’s to be noted that these figures were revised at the 32nd meeting of the GST Council on 10th January 2019. Businesses having the same PAN should be considered as a single entity and the turnover of all the businesses should be taken into account to arrive at the total turnover of that particular entity.

Now, we come to those who are outside the scope of the Composition Scheme. They are:

- Tobacco, ice-cream or pan masala manufacturers

- Those engaged in inter-state supplies

- Non-resident taxpayers and casual taxpayers

- Businesses supplying goods online

Conditions To Be Met For Availing The Composition Scheme

The conditions that need to be met to be able to be a part of the scheme are:

- A dealer who opts for this scheme shall not be able to claim the input tax credit.

- After the implementation of the CGST (Amendment) Act, 2018 from 1st February 2019, a manufacturer or trader is now eligible to supply services to a limit of 10% of the turnover, or Rs. 5 lakhs, whichever is higher.

- GST exempted goods cannot be supplied.

- The words, ‘composition taxable person’ have to be displayed in a prominent spot at the business premises by the taxpayer.

- ‘Composition Taxable Person’ is also to be mentioned on all the bills that the taxpayer issues.

- Payment of taxes at normal rates have to be made for transactions under the Reverse Charge Mechanism.

- If there are separate segments in a business, all the segments should be registered as a single entity with the same PAN under the scheme.

Process Of Opting For The Composition Scheme

GST CMP-02 has to be filed with the government by taxpayers willing to opt for the scheme. One can do so by logging into the GST Portal. A dealer looking to opt for the scheme should give an intimation when a financial year begins.

How To Raise A Bill

A tax invoice cannot be issued by a dealer under the composition scheme as he is not to make his customers pay for taxes. They have to pay the taxes themselves. That’s the reason why the dealer has to furnish a Bill of Supply.

“Composition taxable person, not eligible to collect tax on supplies” has to be mentioned at the top in the Bill of Supply by the dealer.

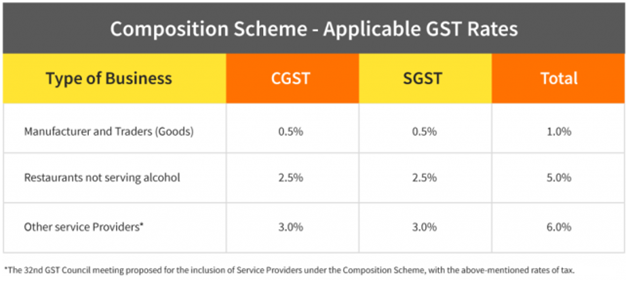

The GST Rates For A Composition Dealer

The chart below shows the GST rates applicable to a composition dealer:

Process of GST Payment To Be Made By A Composition Dealer

A dealer has to make GST payments for supplies made from his own pocket. The payment includes:

- GST on the supplies that are made

- Taxes on purchase of items from a dealer who isn’t registered

- Taxes on the reverse charges

In the context of dealers who aren’t registered it needs to be mentioned that it’s applicable to only those in a specified category of services and goods including the class of notified registered persons which came into effect from 1st February 2019.

The Returns To Be Filed By A Composition Dealer

By the 18th of a month at the end of a quarter, a dealer has to file a return every quarter, GSTR-4. Apart from this, he has to file a return every year, the GSTR-9A by the 31st of December of the following financial year.

One has to note here that a dealer under the scope of the composition scheme is not needed to keep detailed records.

The Advantages Of The Composition Scheme

Having discussed the composition scheme, we now take a look into the advantages that one may enjoy if he chooses to opt for the composition scheme.

- One has to deal with far fewer compliance issues (maintenance of books of records, returns, issuing of invoices, etc.).

- Tax liability is limited.

- With the taxes being of a rate lower than earlier, the liquidity of the business is much higher.

The Disadvantages Of The Composition Scheme

- A dealer is not allowed inter-state transactions and has only a limited territory for business.

- For composition dealers, the facility of the input tax credit is not available.

- The taxpayer is barred from online trading and is not eligible to deal in goods that are exempted under the scheme.

Conclusion

The introduction of the Goods and Services Tax was meant to revolutionize the taxation system in India. Everything has now been brought under the ambit of a single tax with the consumer being levied a tax only at the end of the supply chain. There are certain criteria that a businessman needs to meet to opt for it. A businessman is charged at different rates depending on the nature of his business. While the GST has helped traders and businessmen, it has come with its share of troubles too.

Personal contact info – slikgepotenuz@gmail.com

Permanent Address :- Montville, NJ

CEO and co-founder at Cloudsmallbusinessservice.com