Top 10: Mortgage Calculator Australia Tips

Many calculators are available today for a mortgage calculator Australia. Having some guides on how to use them can help you in the long run.

There are a variety of calculators available that will show you the results for your monthly mortgage repayments, but they don’t have much other information about the mortgage that can help you.

This is a big problem that gets far too many people stuck with their mortgage for far too long. Spending a few hours to learn a bit more about mortgages can save you a few years of mortgage payments. At the same time giving you much better financial security and freedom.

Read More: Top 6 Best Mortgage Calculator in UK

Getting your mortgage paid back in a much shorter time than the full mortgage term might sound very difficult. It actually isn’t and can basically be done by anyone who is looking at getting a mortgage or have one and have the correct knowledge.

The problem with most people struggling with their mortgage is normally that they have too much debt. Many times they got there because they didn’t know how things work and what they can do. They get to a point where is is extremely difficult to do anything to reduce their amount of debt.

They normally then run to the mortgage experts when they struggle to pay back everyone who they owe money. They then get “helped” by these experts who is actually then just getting more money out of them. Sometimes the banks will also “help” by extending the mortgage term to reduce the monthly payments.

All of this isn’t necessary at all if they would take a little time to invest in themselves and learn to understand how they can actually help themselves. Having that knowledge and applying it gives you the freedom to manage your finances according to what is best for you.

There are a lot of different methods to get your mortgage paid back faster. All of these plans is there to sort of force you to get your mortgage paid faster. Some of them complicates the way you make your payments.

This is all done so that you don’t actually see the facts of what you are doing. But it all boils down to doing one thing. That thing is the making of extra payments. The funny thing is that if we don’t know that we are making extra payments it doesn’t bother us. And so it is easier to take the extra money out of our pockets to pay.

It can help a lot of people to use these methods to make bi-weekly payments for instance or refinance to make the mortgage term shorter. The problem is still that the facts is hidden from those people.

For that reason they can’t adapt their mortgage to give them the best results which will help them in their specific circumstances. Just because they don’t have that vital knowledge. People then sometimes have big saving accounts while having a mortgage at the same time. Effectively loosing a lot of interest money because they lack some knowledge.

Do yourself a favor and spend some time playing around with an extra payment mortgage calculator. Start by putting only a few dollars extra each month into the calculator and see how much difference it makes.

Put your bonus or some other lump sump amount as an extra payment each year and then see how fast you can pay back the mortgage. Check the difference it makes to the total amount of interest you need to pay over the full mortgage term.

It sounds extremely difficult to pay your whole bonus or similar amount into the mortgage. I do agree with you. Luckily you don’t need to do it to make a big difference. Every dollar will count more than you think.

When you really understand how much money you can save yourself, paying big extra amounts into the mortgage becomes very easy. But like I said it isn’t always necessary. Many times starting with small things and then building on it eventually has a bigger effect than big lump sump amounts.

This is normally the point at which most people who are looking for help is. They only have very small amounts to start with. When you learn the skills to start small and keep on improving on that it eventually becomes very easy to pay back your mortgage in a short period of time. It is like a snowball building up speed and growing.

Top 10: Mortgage Calculator Australia:

YOURMORTGAGE

Use our mortgage calculator to help you work out your monthly, fortnightly, or weekly repayments. Simply enter your loan amount and interest rate below, and we will calculate your repayments.

YOURMORTGAGE

MONEYSMART.GOV

Calculators and tips to help you make better financial decisions from ASIC and the Australian Government. Free and impartial financial guidance and tools you can trust.

MONEYSMART.GOV

NAB

NAB personal banking financial solutions include internet banking, accounts, insurance, credit cards, home loans and personal loans.

NAB

COMMBANK

With our Home Loan Calculator, you can estimate what your repayments would be. You can also generate a personalised Key Facts Sheet based on your loan amount, term and repayments.

COMMBANK

ANZ

Work out the numbers and explore which ANZ home loan may suit your needs. You’ll also find home loan applications and other forms here.

ANZ

WESTPAC

We offer a wide range of calculators you might find useful when buying a new home, investment property, switching your home loan to us or just looking at how to own your home sooner.

WESTPAC

REALESTATE

We’ve made it easy for you to better understand your finances with our handy home loan calculator. By working out your estimated loan amount, monthly repayments and upfront costs, you can enjoy the confidence of knowing what you can afford.

REALESTATE

ING

ING has 11 different home loan calculators. If you are buying a home you could also check the home buying cost calculator. If you are lucky enough to be thinking of making some extra repayments on your current loan, try the extra home loan repayments calculator.

ING

RAMS

RAMS mortgage calculators have a wide range of uses to help you choose the best home loan. We offer a genuine financial services alternative. Call 13RAMS today!

RAMS

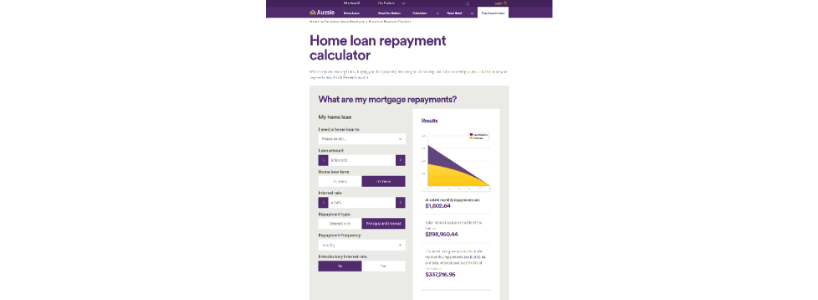

AUSSIE

Whether you’re moving home, buying your first property, investing or refinancing, our calculator will give you a feel for what your payments might look like each month.

AUSSIE