Top 11 Best Mortgage Calculator

By using a mortgage overpayment calculator you can make clever saving decisions. Helping you to pay back your mortgage faster. Constantly making the correct decisions over a period of time will put you in a much better financial position. So how do you know if it is the correct decision?

Read More: Top 10: Mortgage Calculator Australia Tips

This is a topic that keep many people busy arguing for a long time. Most people do not understand the effect that overpaying their mortgage calculator has. Eventually people make their decision about overpaying based on what most people think to be the correct choice. Sometimes on emotion.

The only way to make the correct decisions for your conditions is to do the calculations. Using something like a mortgage overpayment calculator is a thousand times better than using your emotion or other peoples opinion.

The reason why I don’t like to listen to everyone’s opinion is simply that it is wrong most of the time. That is why so many people get to retirement and still have a mortgage to pay. Only then realizing that they have major problems. You can listen to other’s opinions, but always first verify that it is correct.

Many people have the question of what they must do with their extra cash. Put it into a savings account or into their mortgage. There isn’t a simple answer that works for everyone. You have to work it out for yourself. The fact is that paying debt is better than saving.

Here is some scenarios of why you might not choose to pay off your debt.

- You might want to build up a small savings amount to use for emergencies. This is perfectly good to do to be able to have quick access to money for unplanned problems. This of course is much better than paying back credit card debt.

- Some people argue that if they put their extra money into the mortgage they won’t have access to it again. There is solutions to this, it is called an access bond. You can pay extra money in and be able to withdraw it later. For this to work you must have strong willpower so that the extra money doesn’t bother you.

- Some want to upgrade some of their things with the extra money before paying extra on the mortgage.

These are all very valid arguments, which make it difficult to decide when you get emotional about it. I agree that you need to have some money for emergencies, it helps a lot to stop you from using a credit card.

There is something you have to realize when you have debt. The extra money that you have isn’t entirely yours. The financial institution that gave you the debt or mortgage will want you to think that it is. In that way they confuse you and are able to get more interest money out of you.

They actually want you to put the extra money you have into a savings account. They use that money which is actually partly theirs and borrow it to someone else again. That way they will make interest out of you and the next person, and pay you a much lower interest rate to say thank you for saving with them.

Make use of a overpaying mortgage calculator and go see how much faster you are able to pay off your mortgage. The big advantage of not having a mortgage is that you save lots and lots of interest. An overpayment mortgage calculator can literally save you thousands of dollars. You also don’t have the installment that has to be paid every month.

Not having to pay an installment each month is a very big weight that will be lifted off your shoulders. It gives you a life with debt free freedom that very few people experience.

Learn To Calculate Mortgage Rates

So far I haven’t seen a formula to calculate mortgage rates and yet there is a way to get the interest rate.

The easiest way I have found so far is to reverse the process. When you have your mortgage amount, your monthly payment and your mortgage term, it’s not too difficult to get the interest rate.

First you have to subtract all the other costs from your monthly payment. Subtract the house insurance, the bank charges and all other costs from the amount you have to pay back each month.

You can use a normal mortgage calculator to get to the answer. Fill in your mortgage amount and the payment term. Next you need to guess the interest rate. Fill it in and let the calculator calculate the monthly payment.

If the monthly payment the calculator gives is too high reduce the interest rate a little and recalculate the answer. If the monthly payment is too low then increase the interest rate. Keep on doing this a few times until the result is very close to what you have to pay each month without the insurance and bank costs. The answer would then be the interest rate you are looking for.

By using a mortgage calculator I have seen that the mortgage interest rate has a big effect on your monthly payments. Although it has a big effect on how much you pay each month it isn’t the biggest factor in a mortgage.

The one thing that stands out and can have the biggest effect on your mortgage and how much you will eventually pay is the extra payments you make. If you make big enough extra payments each month you don’t have to worry about rising interest rates. It won’t have a big effect in that case.

You can bring down your minimum payment each month if you pay enough extra, even while the interest rates are rising at a fast pace. This is quite a nice feeling when you know your minimum required payments is coming down while everyone else’s is going up. And it is not that difficult when you start to know how.

You can read more in this article – https://www.interest.com

Top 11 Best Mortgage Calculator:

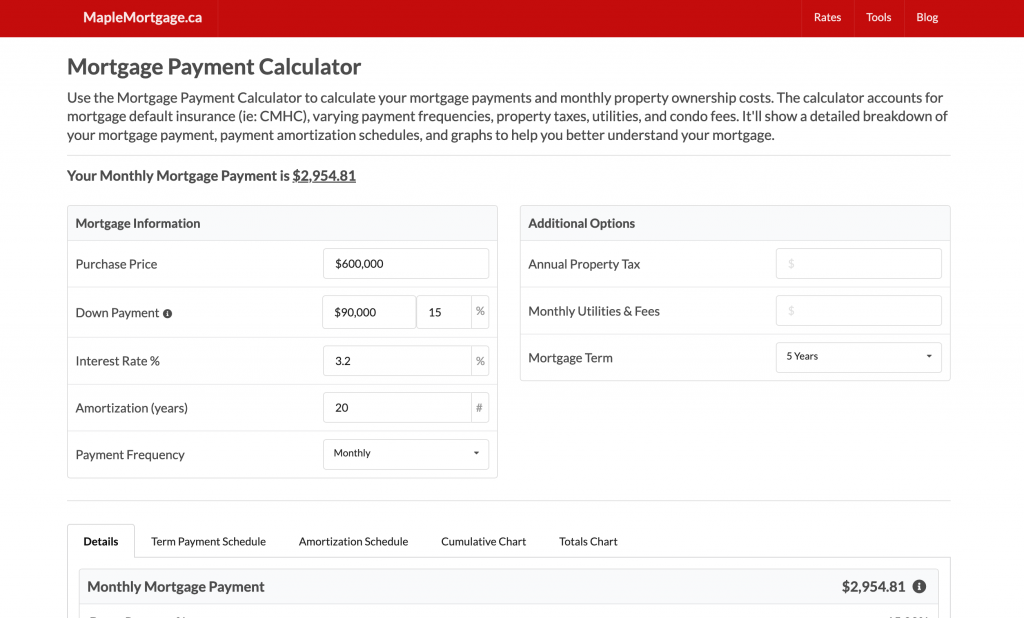

MAPLEMORTGAGE

The Mortgage Calculator will show you your mortgage payment and property ownership costs. The calculator accounts for CMHC insurance, property taxes, utilities, condo fees, and several different payment frequencies, such as monthly, weekly, bi-weekly, semi-monthly, accelerated weekly, and accelerated bi-weekly. The mortgage payment calculator also shows you payment amortization schedules, graphs, and detailed breakdowns of your mortgage interest charges to help you better understand your mortgage payments.

MAPLEMORTGAGE

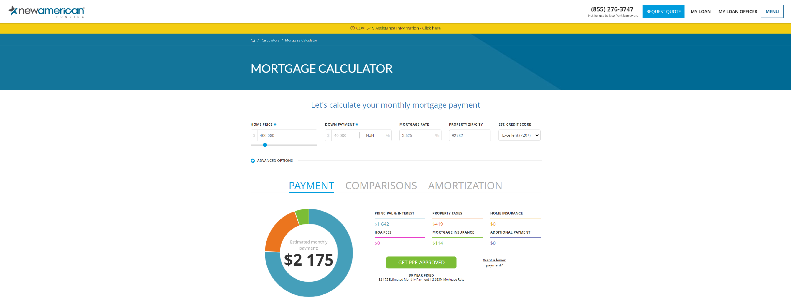

NEWAMERICANFUNDING

New American Funding is a direct mortgage lender offering an array of mortgage loan options including purchase, refinance, and first time home buyer loans.

NEWAMERICANFUNDING

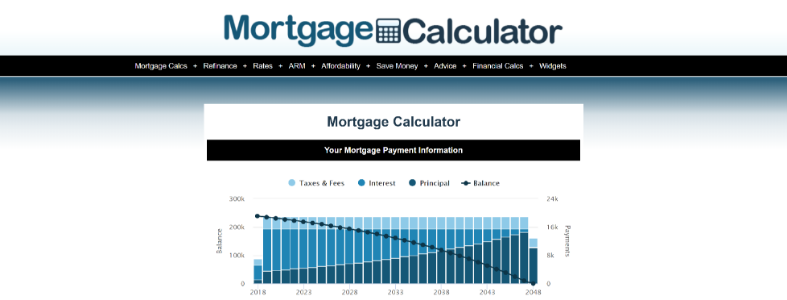

MORTGAGECALCULATOR

Check out the web’s best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes, homeowner’s insurance, HOA fees, current loan rates & more. Also offers loan performance graphs, biweekly savings comparisons and easy to print amortization schedules. Our calculator includes amoritization tables, bi-weekly savings estimates, refinance info, current rates and helpful tips.

MORTGAGECALCULATOR

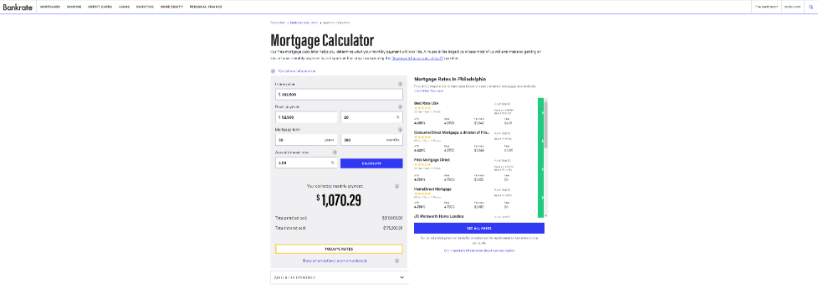

BANKRATE

Our free mortgage calculator helps you determine what your monthly payment will look like. A house is the largest purchase most of us will ever make so getting an idea of your monthly payment is an important first step to answering the “how much house can I afford?”

BANKRATE

MONEYSAVINGEXPERT

Comprehensive mortgage calculator, as well as the basic mortgage calc you can check the impact of savings vs mortgages, offset mortgages, overpayments and more.

MONEYSAVINGEXPERT

HALIFAX

Compare all the mortgages on offer with our mortgage calculator. Halifax’s mortgage calculator can help you get the best rates.

HALIFAX

TD

Use the Mortgage Payment Calculator to discover the estimated amount of your monthly mortgage payments based on the mortgage option you choose.

TD

BMO

BMO offers a wide range of personal banking services including mortgages, credit cards, loans and insurance. Access accounts with 24/7 online banking.

BMO

USMORTGAGECALCULATOR

Free Mortgage Calculator – Calculate monthly payment along with Taxes, Insurance, PMI, HOA & Extra Payments on your home mortgage loan in the U.S.

USMORTGAGECALCULATOR

ZILLOW

Use our home loan calculator to estimate your mortgage payment, with taxes and insurance. Simply enter the price of the home, your down payment, and details about the home loan to calculate your mortgage payment breakdown, schedule, and more.

ZILLOW

BARCLAYS

Use our mortgage affordability calculators to work out how much you could borrow and what kind of deposit you need for a mortgage.

- Work out how much you could qualify to borrow

- See what your monthly payments might be

- Check how an interest rate change could affect you

BARCLAYS

RATEHUB

Compare Canada’s best mortgage rates and credit cards and save! We source the best rates and credit cards so you can find the mortgage rate or credit card best for you.

RATEHUB

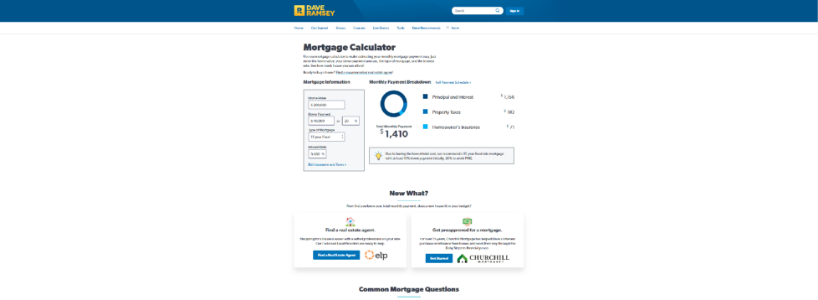

DAVERAMSEY

Use our mortgage calculator to make estimating your monthly mortgage payment easy. Just enter the home value, your down payment amount, the type of mortgage, and the interest rate.

DAVERAMSEY

The Best Mortgage Calculator Will Save Money

When looking for a mortgage calculator, the best mortgage calculator in my opinion would be the one that will save you the most money in the end.

This might not be the one with the lowest monthly payment. If you are looking for a calculator with whom you will get the lowest monthly payment, you should be willing to pay a lot more for your property.

There is a lot of ways to be able to reduce your monthly premiums. Some of them most people will go for and others they won’t. Normally they take the wrong options and this will cost them a lot more than they think. Some of the options are as follow:

- You can increase your mortgage term – not a good idea.

- You can pay the absolute minimum each month – also very bad idea.

- You can shop around before getting the mortgage and get it at a lower interest rate – good idea.

- You can put down a deposit when starting with the mortgage – excellent.

- Pay in your extra money and bonuses into the mortgage – great plan.

- Borrow money from family at a lower rate and rather pay them, then borrow less from the banks -great plan.

- Rent out part of your property and use that income to pay less out of your pocket – excellent plan.

Normally most people will only go for the first two or three options. They will stretch out the mortgage term as far as possible and pay as little as possible each month. The other options might look wrong or people don’t ever think about those options. Though the other options are actually able to help you very much.

The truth can be easily seen when you have a proper mortgage calculator that shows you what is really happening. With this type of calculator some of the facts aren’t disguised for you to miss them. You can be able to calculate exactly what effect each of the different techniques will be having.

According to me a mortgage calculator that shows you exactly what is happening and helps you to save money in the long run would be the best one to have.

Don’t be fooled into thinking that if you are able to pay less each month that you are really always saving. A lot of times it is the exact opposite.

Mortgage Repayment Calculator – Extra Payments

When you have a mortgage repayment calculator you can start to work out a few things that can help you. You will be able to see the minimum repayments you need to make each month to be able to finish paying back the mortgage over the full mortgage term.

This minimum payment is commonly referred to as your monthly repayment or installment. Often people think that the monthly repayment amount is a predetermined amount that they must pay. They think that the total interest of the mortgage is added to the amount that you borrow.

They think that you just have to pay back the total amount and that there is nothing you can do to change it. For that reason they pay the minimum each month to “save” themselves some money and have more left to survive on.

It is exactly this way of thinking that is keeping people poor and keeping them in a constant struggle. The banks absolutely love this way people thinks. This way of thinking helps them to make massive profits each year. And a lot of struggling people are helping them to make these profits.

Now the question would be. Why would you help the banks make huge profits if you can help yourself to keep that money and improve your own situation?

Maybe it is the way people think. They think they will be better off paying back the minimum each month. Then using their extra money to try and invest it somewhere where they will be getting better interest rates than what they have to pay.

So eventually they might think that they can pay back the debt out of the money they made from “investing” and will be left with some extra. This could be true in some situations, but over the long term they would most probably loose a lot more than they gained. And this is why many people struggle.

Think about it. Why would the banks borrow people money if they could use the same money to get much better returns on let’s say the stock markets as an example? Would they borrow people money if they could consistently do better on the stock markets?

What does that tell you?

Using your extra money to pay back your mortgage can help you to pay back a lot less interest. Any extra payments that you make more than the installment will go towards reducing the outstanding capital amount. And the best of all is that there is no guessing about what the results of your investment will be. You can see it on a mortgage calculator.

You will be able to see what effect it will have if you start paying extra. You will see exactly by how much your total interest will be dropping and can even see how much faster you will be paying back the mortgage.

There aren’t circumstances where the markets will suddenly drop and leave you with big losses like with stock markets. When you pay extra money into your mortgage you will always win by paying back smaller and smaller amounts of interest in total. You will also win by bringing down the total amount of years you still have to pay.

There are some times when it is a good decision to borrow some money to do business. Though there is risks involved.

When you have a mortgage calculator and other calculators you can start comparing the results you will be getting by using your extra money in different investments. You can look at the different risks involved in the different investments and then make an informed decision.

A Buy To Let Mortgage Calculator And It’s Advantage

The advantage of having a buy to let mortgage is most probably that you can get it at a lower interest rate. To calculate how much you will be able to borrow you can use a buy to let mortgage calculator.

There are some things to consider before you get a buy to let mortgage.

Here they are:

- You will most probably need to put down a much bigger deposit than when getting a normal mortgage. This could require you to save up a lot before being able to get such a mortgage. Be sure to have saved enough before getting this type of mortgage. In the beginning you will normally spend a lot on repairs before being able to start renting out the property. This might leave you with cash flow problems.

- The institution that will give you the mortgage could and normally will require you to get a rental income that would cover the mortgage payments plus a certain percentage. This is a good investment principal. Though it might sometimes make it difficult for you to rent out the property, as you can’t lower your prices much to be more competitive.

- The mortgage lender might look at the property to see it’s future and long term potential before giving you the mortgage.

The reason why you would be able to get the mortgage at a better rate is because there is a much smaller risk for the lender to loose their money. This is because you will have your normal income and the rental income, so there is two income streams. For that reason there is a smaller chance that you won’t be able to pay and so they could give you a lower interest rate.

Remember that rental properties aren’t always occupied. In those months you won’t get any rental income and you will need to make the payments from your own pocket. Be sure to make provision for that or you might run into trouble soon. Be sure to have very little debt before buying a to let property.

Buy to let properties can be a excellent investment when you understand how it works and what to look out for before buying them.

An Easy Mortgage Calculator Can Mislead You

Looking for an easy mortgage calculator to work out repayments might not be the best thing to do. There is a lot of very valuable information you would miss by doing that.

Maybe people look for it because they quickly want to calculate something. The other reason could be that they don’t really understand how mortgages work and are just looking for an easy calculator to do some calculations.

I agree that mortgage calculations can initially be a very difficult thing to understand, but taking the time to really getting to know what is happening in a mortgage can be very rewarding. This is something I can really testify about.

Most banks don’t want you to know what is really happening with your money in a mortgage. For them it is much better if you pay your installment every month and then forget about your mortgage for the rest of the month.

Why would it be the best for them if you don’t really understand what is going on? Maybe they want to be nice and not bother you with all the small details.

For you life would be a lot less complicated if you don’t have to know about all these things. It is much more convenient to pay your installment and get it over and done with and then concentrate on your life and the things you have to do.

Well maybe if you think that way you might be right. But there is the chance that you aren’t right and that you are not being told the whole truth for a reason.

That reason might be that the banks wouldn’t be able to get as much money out of you if you were a bit more educated on mortgages. When you start understanding how mortgages works, you will see and understand lots of things that you never thought about. These are things that can be able to help you a lot financially if you know how to use it.

For example you are able to pay off a mortgage much quicker than they say you need to and by doing so save yourself a lot of money. This means that you would be paying a lot less for your house than what you initially had to.

Most people will only pay the absolute minimum on their mortgage as they think it costs them less when they pay less. This couldn’t be further from the truth. The bank that borrowed you money won’t really tell you that. If lots of people would find out how little they could pay when applying the correct techniques, banks would be making a lot less profits. This would be bad for the business of the banks.

You could keep these profits the banks makes out of you to yourself. The first step would be to start to realize how mortgages works. Then learn techniques that you can use to pay a lot less on your mortgage. At the same time you will be becoming less and less strangled in debt.

Being debt free is something a lot of people might be wishing for, but they don’t know how. You could be without debt in just a few years from now if you really want to be, no matter how much debt you have.

All of this will only start after you have decided to change the way you think about things. You need to understand what is happening with your finances and how you can improve it. Then you keep on improving your financial situation and other areas of your life.

A Commercial Mortgage Calculator and Others

What is the difference between a commercial mortgage calculator and a normal one you might ask? The answer is not too complicated.

The main difference between a commercial mortgage calculator and a normal mortgage calculator is normally the mortgage period. So the time that the commercial mortgage has to be paid back in is normally shorter. You will get a mortgage period of 10 years for example in which it has to be paid back.

The difference is that you will only need to make a minimum payment as if the total amount had an amortization period of 20 or 30 years. So if you keep paying the minimum amount each month, you will pay back the loan in 20 or 30 years time.

But you can’t as you need to finish paying back the total amount after 10 years. If you keep paying the minimum each month, eventually you will have to pay a big amount at the end of the 10 years to pay back everything. Other options you can use in order to pay back the loan within the 10 year period can be to make big deposits from time to time or pay more each month.

So you can use a normal mortgage calculator to work out the minimum installments and make the amortization period 20 or 30 years. Just remember that the total loan will need to be paid back in a shorter period of time.

There are some other differences when it comes to the way they determine how much the amount is they will lend you. With a non-commercial property the loan amount is limited by the value of the property you want to buy and by your monthly income. There is also a lot of other factors that they use to determine the interest rates etc. but the monthly minimum payment calculations will work the same.

This is totally different when it comes to commercial loans. There the loan amount would be determined by the amount of income that is generated from this type of property. So for example if you buy a building with twenty shops and only five of them are rented out, you will struggle to get a loan for the full amount you bought the building for.

If all of the shops are rented out and they generate enough income you would be able to get a much bigger loan that could cover the total amount you paid. You will be paying a lot more for that type of building, as the owners wouldn’t easily let go of such a property.

So the value of a commercial property is determined by the amount of income it is generating and can be able to generate. As for the rest of the calculations to determine the monthly payments, the interest part and capital part it works the same as any other mortgage.

A Mortgage Interest Calculator is One of the Keys To Financial Freedom

Having a mortgage interest calculator can be one of the most useful things on your way to financial freedom. Let me briefly explain what financial freedom means.

When you have a passive income that is at least double your expenses at retirement, you are financially free. This income will need to last you until you would be at least 100 years. It means you wouldn’t run into financial problems during your retirement, even when you occasionally have more than your normal expenses.

Most people run into financial problems about 5 to 10 years after they had retired. They then realize that they will have to drastically reduce their expenses or would have to go back to working. Normally at that stage after they stopped working for a few years most employers don’t want to take them back or give them a job.

Why would I say a mortgage interest calculator is one of the keys to financial freedom? For you to be financially free you need to reduce your debt to eventually end up with no debt. The faster you can get rid of your personal debt the faster you can start making investments that can give you enough passive income for retirement.

When you have an interest calculator you will see how much your mortgage will actually cost you. The idea isn’t to see how much your debt will eventually cost you and to then accept it. That wouldn’t benefit you much.

The whole idea of having a mortgage interest calculator is to be able to calculate the amount of interest that you would have paid. Then you start putting in different variables and seeing what effect they have. You can then adjust the values to fit your circumstances until you get the results you want to. Then you can go and practically apply it and get the results.

When you have an interest calculator you can properly plan your finances and will be able to start working towards a goal. You will know what you are working towards even before you start and will see what the potential results will be.

This goal will be motivating you, as it sometimes can be very difficult to stay motivated if you do not know what the results will be. When you know how much of your money will be going towards paying back the mortgage capital and how much will go towards interest, you can start using that to help yourself.

Making a few simple changes to the way you go about paying your mortgage back can make a massive difference to the results you will get. This is something most people don’t know and never apply these techniques.

They end up at retirement having financial problems and don’t know what to do about it. They blame their circumstances and everyone around them except blaming themselves.

Most people don’t realize that they could have had entirely different results if they only understood their mortgage and how to manipulate the results they would get. This is something you can learn in a few days time and it can make a difference during many years in your life.

Yet people tend not to spend much time educating themselves financially and end up in situations they never wanted to be in. With this education I don’t mean a financial degree, I mean simple education that can give them the correct results.

Start taking the responsibility on your own shoulders and get some education that can give you the wanted results, and not only the papers. You would be thankful to yourself for the rest of your life for taking some time to educate yourself.

House Mortgage Calculator

Do you really understand what is happening within a house mortgage calculator? Well, most people don’t and this is one of the reasons they struggle financially.

Why would most people keep on paying their installment every month without understanding where their money is really going? Normally when we take out money to pay for something we want to know exactly how much it costs and want to get the correct change back. We normally aren’t happy when we pay and get much less than we thought we would get.

But yet when it comes to our mortgage where there are big amounts of money involved, we are happy paying without any questions. Maybe this is because we trust the institutions that borrow us the money. They are very professional and wouldn’t do anything that could harm their reputation or us, or so we think.

Yes they might not be cheating you in any way, but they might hide vital information to be able to get a lot more money out of you.

Have you ever gone and found out how much you are really paying off on your mortgage every month? Well you will see mortgages a lot different if you have asked some questions and found out what is going on.

Let me explain it to you in this way: Mortgages is structured in such a way that especially in the beginning, you will be paying very little off your mortgage. You will be paying mostly interest and will pay very little that would be going to reducing the amount that you owe.

This means you will pay a lot of interest money to the banks that they will gladly receive. At the same time you are paying all this interest you will be paying back very little of your mortgage.

Now you might ask if there aren’t ways that you can use some of this money that goes to paying interest to reduce the amount you owe? The answer is a definite yes. You can pay back your house mortgage in a much faster time than you planned.

You do this by effectively using the money that you would have paid on interest to pay back the mortgage faster and faster. It is like a snowball effect. As soon as you get the process to start it becomes easier and easier to get the mortgage paid faster.

You might think that it is difficult techniques you need to use to pay your mortgage off in a few years. The problem for most people is that the process is actually such a straight forward one that most people overlooks it and doesn’t apply it.

When you have a house mortgage calculator you will be able to see what the short and long term effect will be if you do something. This is a great tool to help you decide what to do. You don’t have to rely on what everyone is telling you. When you have your own calculator you can be able to make calculated decisions that is based on math and not on peoples feelings.

This will help you to make the correct decision as to what to do. I am sure most of us have been pushed into some deal because it sounded very exciting. Only after we signed or bought the product did we discover that it have very little value and it wasn’t going to give us the results we thought it would.

This is what is so nice about having a mortgage calculator. You don’t have to listen to everyone. You can put in the variables and see exactly what will happen. If you aren’t happy with the results you will be getting, you can use different techniques until the result looks good. Only then you do what you calculated.

If you don’t get the results you wanted, you don’t have to waste a lot of money to find that out. So before you buy your house you can go and see for how much you can buy. You will be able to see what the effect will be if you buy a little bit cheaper place. You could see how much you would be able to save yourself by just paying a little extra.

When having a mortgage calculator you are able to change one of your biggest monthly expenses from going to interest, to something that reduces a lot of your debt.

The difference is just in the way you understand mortgages and use your money. Lots of people are able to become debt free and financially secure in a few short years because they have taken the time to know what is really happening to their money.